Questions to Ask a Bookkeeper Before You Hire

Questions to ask before you hire

Hiring a bookkeeper can be a great way to take the burden of managing your finances off your shoulders, but it's important to choose the right bookkeeper for your business. In this blog post, we'll explore some questions to ask a bookkeeper before you hire, to ensure that you find the best fit for your business.

#1 How long have you been bookkeeping for businesses of this size and type?

It's important to find a bookkeeper who has experience working with businesses similar to yours in terms of size and type. This will ensure that they understand your specific needs and can provide you with the best possible service. Ask the bookkeeper about their experience working with businesses of your size and type, and consider how long they've been in the field.

#2 What accounting software do you feel most comfortable using?

Different bookkeepers may have different levels of experience and proficiency with different accounting software. It's important to find a bookkeeper who is comfortable using the accounting software that you prefer, or who is open to learning new software. Ask them what accounting software they're most comfortable using, such as QuickBooks or Xero.

#3 Do you have experience preparing financial statements and tax returns for businesses in our industry?

Different industries and geographic regions may have different regulations and requirements when it comes to taxes and financial statements. It's important to find a bookkeeper who has experience preparing financial reports for tax returns for businesses in your industry or geographic region. This will ensure that they understand the regulations and requirements specific to your business.

#4 Can you provide me with a few references from clients who are similar to us?

As a beginner, it's a good idea to consider hiring a bookkeeper to help you with your bookkeeping. A bookkeeper can help you set up a system for tracking your expenses and income, and can also help you with things like invoicing and payroll. This can free up your time to focus on running your business, and will also ensure that your financial records are accurate and up-to-date.

#5 How do you determine your rate?

When hiring a bookkeeper, it's important to understand how they determine their rate whether it is a monthly set rate or an hourly rate. This will help you budget for the costs of hiring a bookkeeper and ensure that you find a bookkeeper who fits within your budget.

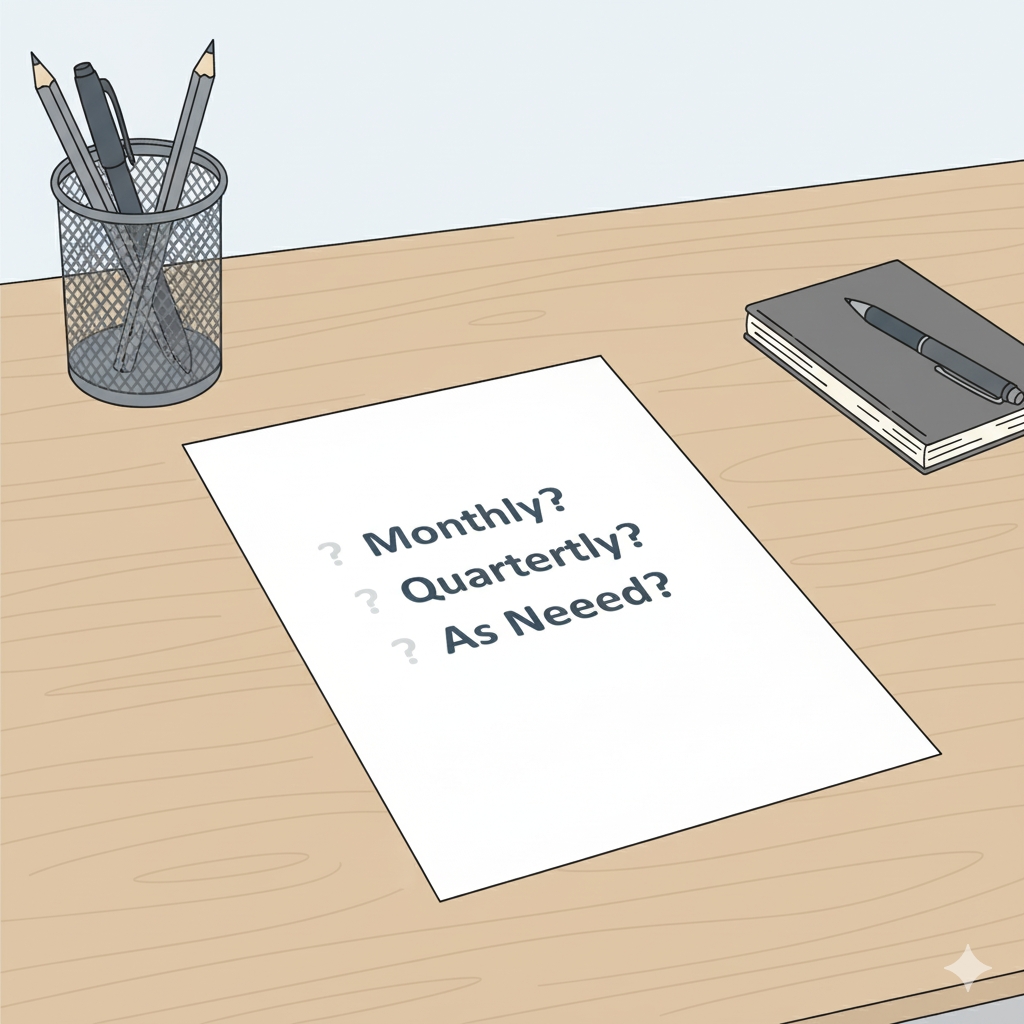

#6 How will you bill us - monthly, quarterly, or as needed?

It's important to understand how the bookkeeper will bill you for their services. Will they bill you on a monthly, quarterly, or as-needed basis? This will help you budget for the costs of hiring a bookkeeper and ensure that you're comfortable with their billing schedule.

Sum it up!

In conclusion, hiring a bookkeeper can be a great way to take the burden of managing your finances off your shoulders, but it's important to choose the right bookkeeper for your business. By asking the right questions, you can ensure that you find a bookkeeper who has experience working with businesses similar to yours, is comfortable using your preferred accounting software, understands the regulations and requirements specific to your business, and fits within your budget. Remember, a good bookkeeper is a valuable asset for any business, and it's worth taking the time to find the right fit.